Smart Tips to Buy a House: A Guide for Confident Homebuyers

Smart Tips to Buy a House: A Guide for Confident Homebuyers

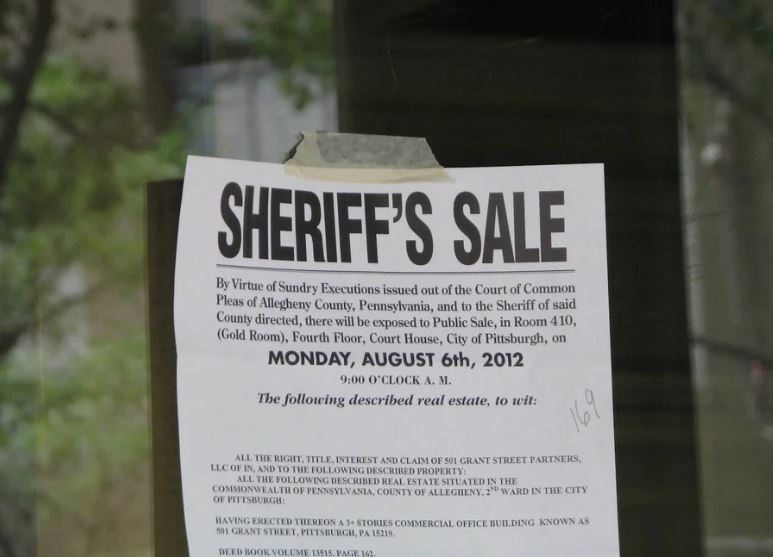

https://www.owebacktaxesproperty.com/stopping-a-sheriff-sale

Buying a house is more than just a financial decision—it's an emotional milestone and often one of the biggest investments in life. Whether you're a first-time buyer or looking to upgrade, navigating the process can feel overwhelming. To help you make confident and informed choices, here are some essential tips to consider when buying a house.

https://www.owebacktaxesproperty.com/we-buy-houses-bay-area

1. Define Your Needs vs. Wants

Before you even browse listings, create two lists:

Needs: non-negotiables like number of bedrooms, location near work/school, or budget limits.

Wants: features you'd love, such as a big backyard, a swimming pool, or a modern kitchen.

This clarity helps you stay focused and prevents emotional decisions that could derail your budget.

2. Set a Realistic Budget

Don't just think about the purchase price. Factor in:

Property taxes

Insurance

Maintenance costs

Utilities

Potential homeowners' association (HOA) fees

Use the "28/36 rule": Your mortgage should not exceed 28% of your gross monthly income, and total debt should not exceed 36%.

3. Get Pre-Approved for a Mortgage

Pre-approval shows sellers that you're a serious buyer and gives you a clear idea of what you can afford. This step can also save time when making offers in a competitive market.

4. Research the Neighborhood

The house is only part of the equation—the neighborhood matters just as much. Investigate:

School ratings

Safety and crime statistics

Commute times

Access to grocery stores, parks, hospitals, and public transport

Visit the area at different times of day to get a true feel of the environment.

5. Work with a Trusted Real Estate Agent

An experienced agent can guide you through:

Market trends

Negotiations

Paperwork

Potential red flags in listings

Their knowledge often saves buyers time, stress, and money.

6. Inspect Before You Commit

A professional home inspection is non-negotiable. It can reveal costly issues with plumbing, roofing, foundation, or electrical systems. Use the inspection report to negotiate repairs or a better price.

7. Think Long-Term

Ask yourself:

Will this home fit my lifestyle in 5–10 years?

Is it located in an area likely to appreciate in value?

Does it allow flexibility for changes, such as starting a family or working from home?

Buying with the future in mind ensures your home remains a solid investment.

8. Don't Rush the Decision

Falling in love with the first home you see is common, but patience is key. Compare options, revisit properties, and analyze the pros and cons before signing any contract.

Final Thoughts

Buying a house is a journey that blends numbers with emotions. By staying informed, setting boundaries, and planning ahead, you can find a home that fits both your lifestyle and financial goals. Remember, the right house isn't just a property—it's a foundation for your future

.